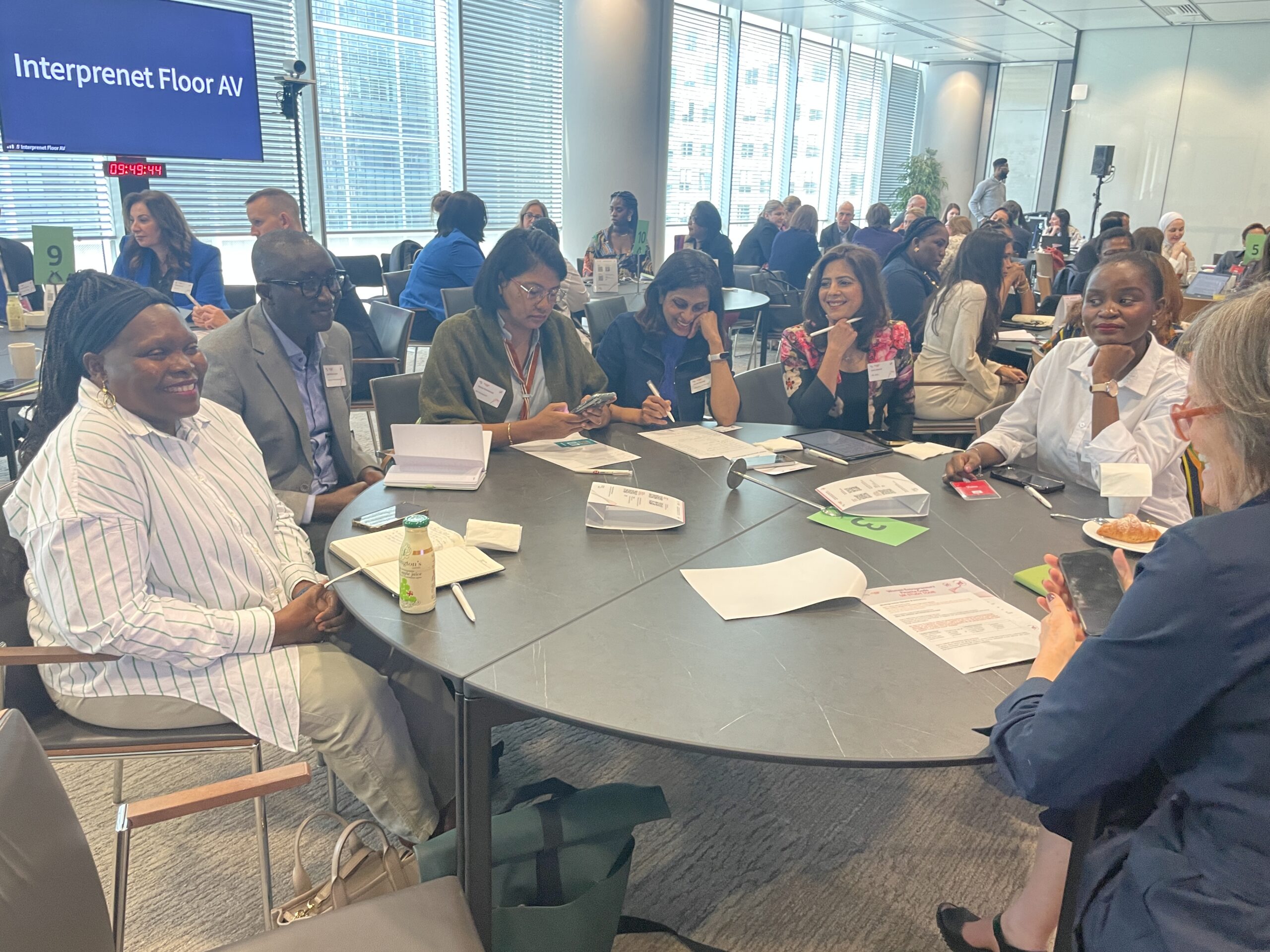

In June, 94 global leaders in women’s entrepreneurship finance met in London to study the results of the Investing in Women Code in the United Kingdom, and to exchange knowledge on the ongoing implementation of the WE Finance Code.

The global leaders, invited by the Women Entrepreneurs Finance Initiative (We-Fi) and the Financial Alliance for Women, came from countries including the Dominican Republic, Mozambique, Egypt and Rwanda. The large turnout shows the momentum building around the WE Finance Code, We-Fi’s global voluntary commitment by financial service providers, regulators, development banks and other financial ecosystem players to increase funding for women entrepreneurs.

The study tour for global leaders was held in London because of the U. K’s pioneering Investing in Women Code, which helped inspire We-Fi’s global effort. Kevin Hollinrake, Minister for Enterprise, Markets and Small Businesses, U.K, joined the gathering, which also included leaders from British banking and finance institutions who shared their experiences in designing data systems and integrating the results into their products.

Momentum Continues for the WE Finance Code

“We have seen the WE Finance Code take off like wildfire. It’s very simple in concept and it’s very powerful,” Inez Murray, the CEO of the Financial Alliance for Women, told a global audience earlier this year. “I haven’t seen progress like this in all my years working with banks.”

The next year will be critical, as more countries form National Coalitions to advance systemic change in finance on behalf of women entrepreneurs, according to Wendy Teleki, head of the We-Fi Secretariat. Globally, women face a $1.7 trillion financing gap, according to the World Bank. The WE Finance Code, like the UK’s Investing in Women Code, is designed to gather data on the market for women’s entrepreneurship finance, as a fundamental step to drive more and better financial products for women entrepreneurs.

Read the text of the WE Finance Code here.

“Data is the beginning of the change we see from the WE Finance Code,” said Teleki. “As more people understand the potential of women entrepreneurs, people’s mindsets will shift. We’ll achieve the more equitable financial system.”

In each country, the WE Finance Code is implemented by recognized National Code Coalitions. Coalitions include:

- A public declaration of intent to introduce the Code in country, adhering to the minimum guidelines of the Code’s global framework.

- Governance that creates oversight and accountability for local adoption of the Code.

- Designated coordinator to oversee local implementation and interface with and report to the Code’s global coordinator.

- A mechanism to aggregate data with integrity and in a format that will facilitate mainstreaming

So far, there are 12 recognized National Code Coalitions. (Link to Map)

- Dominican Republic

- Indonesia

- Uzbekistan

- Fiji

- North Macedonia

- Mozambique

- Tajikistan

- Senegal

- Egypt

- Cote d’Ivoire

- Montenegro

- Sri Lanka

Importantly, the Investing in Women Code is doing exactly what it was designed to do: gathering data that illuminates trends and areas where progress is needed – and is helping to build momentum for greater change. Early results offer insights for people working to establish and expand the WE Finance Code in their countries.

Launched in 2019, the U.K.’s Investing in Women Code is a voluntary effort at the national level. As of March 2023, the latest information publicly available, there were 204 signatories to the Investing in Women Code, signatories that include lenders, venture builders, limited and general partners in investment funds, and others. You can see a history of the initiative here.

“The Code is proving to be an effective mechanism to drive greater equality in entrepreneurship finance,” according to the U.K’s Women-led Enterprise High Growth Taskforce, which included an assessment of the Investment in Women Code in its report issued in February. The Taskforce, formed by the previous U.K. government, focused on the question of how to increase the number of women-led high-growth businesses, particularly outside London.

The United Kingdom, similar to other countries, has seen a surge in entrepreneurship, including among women and youth, in the aftermath of the global pandemic. At the same time, data shows there are still wide gaps when it comes to helping fledgling companies founded by women grow. And, the data also shows that focused attention on particular levers within the financial system may make a difference, such as the presence of women leaders in investment decision-making.

According to the British Business Bank’s 2023 report on the results of the Investing in Women Code:

- Three years after the Investing in Women Code was launched, women-led businesses continue to experience a significant finance gap in loans. In 2022, the average (mean) amount approved in respect of women-led businesses standing at £174,000, which was 34% of the average of £507,000 approved for their male-led counterparts, according to the British Business Bank.

- A higher percentage of VC deals made by Code signatories feature at least one female founder (35%) as compared to the wider market (27%), according to the Bank’s report. This is the third year in a row that signatories have outperformed the VC market. The number of deals made by VCs with all-female teams rose from 6% in 2021 to 9% in 2022 in the broader market, bringing it in line with the levels achieved by VC signatories which remained constant for the last year.

- VC firms that have signed up to the Code represent a larger share of the market than ever before. The proportion of UK VC deals involving a signatory has risen from 24% in 2020 to 39% in 2022.

The Women-led Enterprise High Growth Taskforce identified three areas in which the Investing in Women Code could be advanced: adding more limited partners, adding more growth funds, which invest in more mature businesses, and adding more private debt funds. The Taskforce suggested the push for more signatories from all three groups should be led by the Department for Business and Trade, working in partnership with the British Business Bank and the British Private Equity and Venture Capital Association.

The continued momentum around the U.K’s groundbreaking work offers inspiration and potential pathways for WE Finance Code Champions working around the world to help women entrepreneurs obtain financing.

Please forward this blog post to people interested in women’s entrepreneurship finance, or invited them to sign up for the Code Communique, here. Or, follow the WE Finance Code on LinkedIn.