Co-organized by:

Wednesday, October 2 | 9:00 – 10:00am EST

Digital platforms are increasingly vital in providing financing to women-led businesses (WSMEs), including the most disadvantaged women entrepreneurs. Despite this potential, a BIS study highlights a substantial ‘fintech gender gap,’ with 29% of men and only 21% of women utilizing fintech services. Digital financial services offer a chance to overcome mobility constraints and improve access to financing for WSMEs, potentially leading to enhanced asset control and decision-making power for women. However, challenges such as gaps in connectivity, digital skills, and trust still hinder women’s full participation in these opportunities.

Objective

The goal of this webinar was to examine the role of fintech companies and digital financial services in women’s financial inclusion and empowerment. It will present the latest insights from the IFC “Her Fintech Edge” report, which shows that many fintech firms report that women constitute less than 25% of their customers – with lower representation among business customers and lending-focused fintech firms. Moreover, data from the report indicate that 59% collect sex-disaggregated data, but few use it, less than a third tailor their products and services towards women.

Additionally, the session explored how initiatives like the WE Finance Code can enhance the availability of sex-disaggregated data and financing for WSMEs through collaboration with fintech companies, leveraging the promising evidence that these firms can effectively target women customers by analyzing sex-disaggregated data and tailoring their products and services to meet women’s specific needs and behaviors. The Code is a commitment by financial service provider (including fintechs), regulators, development banks, and other financial ecosystem players to work together to increase funding provided to women-led micro, small and medium enterprises (WMSMEs) around the world, so that they can grow and add value to the economy and their communities.

We will brought together We-Fi Implementing Partners, donors, and other ecosystem stakeholders to discuss these findings and explore practical solutions.

9:00 – 9:05 AM: Welcoming Remarks

- Wendy Teleki, Head of We-Fi Secretariat

9:05 – 9:25 AM: Presentation of main findings of the Her Fintech Edge report (IFC)

- Anushe Khan, Senior Operations Officer, IFC

9:25 – 9:30 AM: Implementation of WE Finance Code with Fintechs

9:30 – 10:00 AM: Panel discussion

Moderator:

- Wendy Teleki, Head of We-Fi

Panelists:

- Susanne Hannestad, CEO, FintechMundi

- Matthew Mims, Co-Founder and CEO, hiveonline

- Ann Marie Williams, COO, Creditas

Anushe A. Khan – Senior Operations Officer, FIG Banking on Women and Financial Inclusion, Financial Institutions Group

Anushe has more than 20 years of private sector experience in financial services in emerging markets, firstly as a banker in the areas of credit, loans and guarantees addressing the needs of SMEs, retail and corporate sectors, followed by extensive experience in IFC, in financing MSMEs through the financial services sector in emerging markets. She has led projects with banks, non-bank Financial Institutions and other financial services providers, focusing on SMEs, Women-owned enterprises and under-served segments in rural areas. Most recently, within IFC’s Banking on Women program she leads IFC’s global investment and advisory services facilities for the Financial Institutions Group such as the Women Entrepreneurs Financing Initiative (WE-FI), the Women Entrepreneurs Opportunity Facility (WEOF), supported by IFC and the Goldman Sachs Foundation. Anushe holds a Master’s degree in International Relations from Georgetown University, USA and a Bachelor’s degree in Business Administration from the Institute of Business Administration Dhaka, Bangladesh.

Susanne Hannestad, CEO at Fintech Mundi AS, Board Director at ClearBank Group Ltd, Triodos Bank NV (publ), Zimpler AB, Crunchfish AB (publ), and Monty Mobile Ltd.

Susanne is an experienced international non-executive board director and executive director in the industries of Financial Services, Financial Technology, Financial Inclusion, Cards, Payments and Insurance. She is former Board Director at Nordax (publ), Chair of Board at Neonomics, Executive Chairman at Zwipe (publ) building the Zwipe Payment for global scale, and she was Advisory Board member at Mastercard Europe. Prior to joining Fintech Mundi, Susanne was Executive Director at Nordea building up the Cards, Acquiring and Unsecured Lending business across the Nordic and the Baltic.

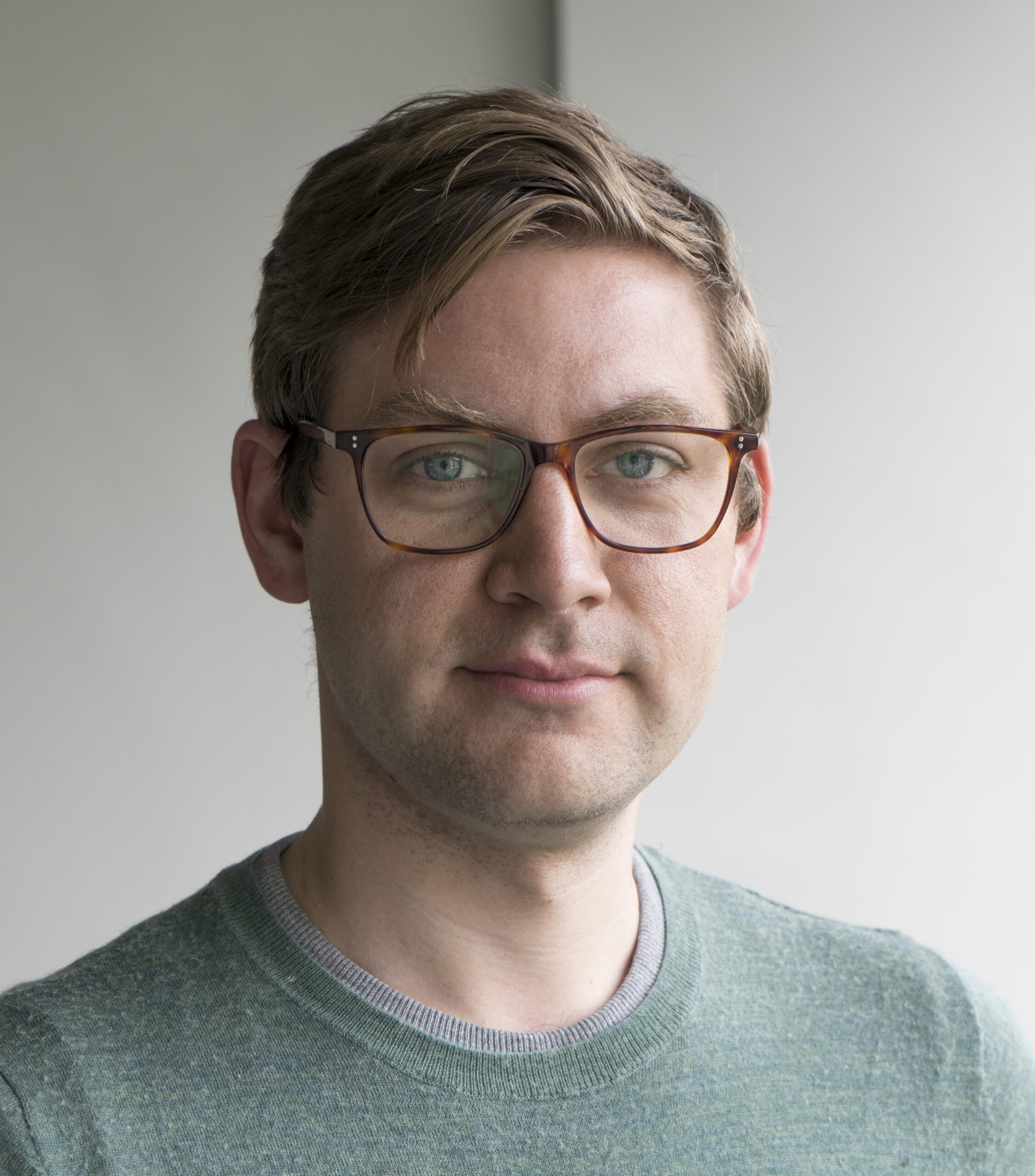

Matthew Mims, CEO and Co-founder, hiveonline

Matthew is an impact fintech leader with extensive experience in financial services across startups and large enterprises in both developed and developing economies. His work at hiveonline, driven by a passion for financial inclusion and market access, focuses on empowering the African informal economy through mobile-based digital technology, particularly supporting women farmers in savings groups and cooperatives. The company aims to provide access to financial services, agricultural inputs, and market buyers for marginalized communities. Before hiveonline, Matt held transformation roles at Nordea Bank and Barclays Bank and serves on advisory boards, including the EU Digital4Development Private Sector Advisory Board and the Digital Savings Group Hub Advisory Board.

Ann Marie Williams, COO, Creditas

Ann is the COO at Creditas since 2016. She has been involved with startups for most of her career. Ann was co-founder and CEO of Okto in Brazil, leading the company for 10 years from launch to acquisition. Before joining Creditas, she evaluated opportunities and supported the portfolio as a Venture Partner with Redpoint e-Ventures. Ann also consulted for Diamond Cluster, Deloitte and USAID. She is a graduate of Stanford University and has an MBA and a MPAffairs from the LBJ School at the University of Texas at Austin.

Wendy Teleki, Head of the We-Fi Secretariat

Wendy Teleki is Head of the We-Fi Secretariat, which is housed in the World Bank Group. The Secretariat is responsible for supporting the We-Fi Governing Committee in the allocation and supervision of We-Fi funding as well as communications, advocacy, and learning focused on strengthening opportunities for women entrepreneurs in collaboration with the GC, Implementing Partners and other stakeholders. Ms. Teleki joined We-Fi in May 2019. Prior to that, Ms. Teleki worked with the International Finance Corporation leading numerous activities and initiatives focused on small and medium enterprise development in emerging markets around the world. This included several blended finance, investment and advisory programs, including IFC’s We-Fi program and the Global SME Finance Initiative. Wendy has an MBA in Finance from the Wharton School of Business and an MA in International Economics from the Johns Hopkins School of Advanced International Studies.

Presentation

- FIG Banking on Women Fintech – Anushe A, Khan, Senior Operations Officer, IFC