STEP 3C

Establishing national definitions: The Code does not impose definitions of “microenterprise,” “SME,” and “women-led/owned firm,” empowering national programs to establish a single set of harmonized definitions for FSP and other Code signatories to use at the country level. These definitions should be harmonized with global best practice. The one-year grace period for data collection offers an opportunity to engage key policy makers and regulatory bodies on establishing national definitions. While not recommended, countries can forego national definitions. In this case, FSPs must disclose the definitions they use to ensure their definitions meet Code standards and the associated data fall within the scope of the Code.

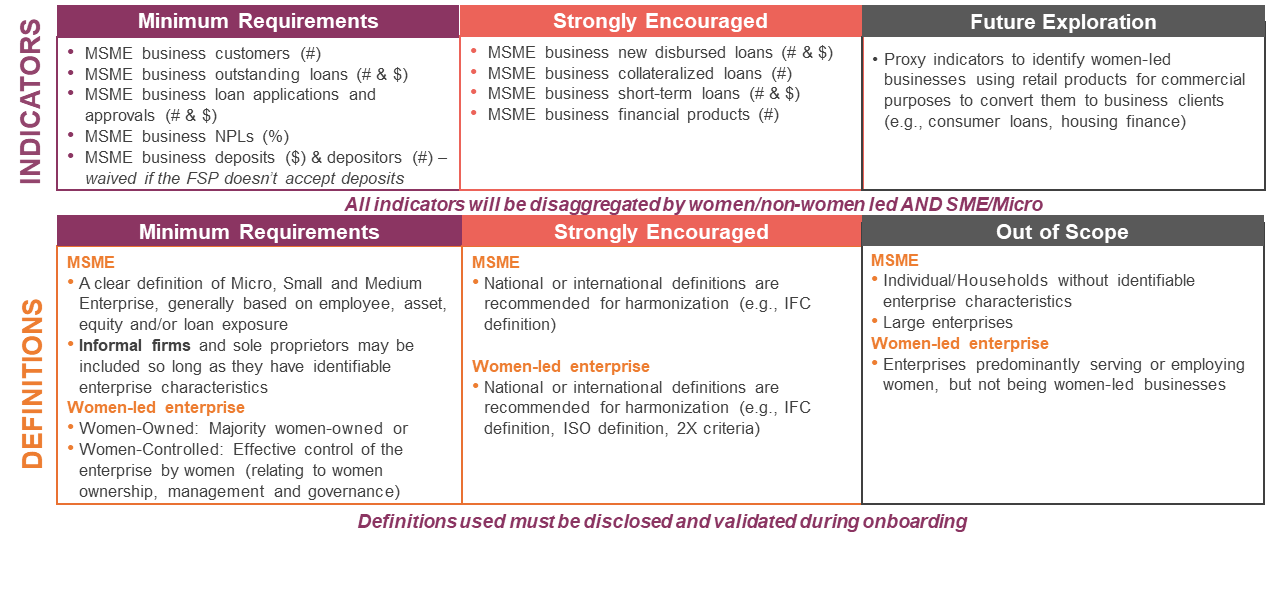

Setting indicators: All FSP signatories of the Code are required to report on five core indicators, disaggregated by sex (women-led and other) and size (micro and SME). These five indicators were selected for their ability to help most FSPs establish a baseline for lending to women entrepreneurs, track its growth over time, understand pipeline and performance constraints, and build the business case. They also help regulators understand if WMSMEs are inclusively financed.

The National Coalition decides which additional indicators, if any, it requires signatories to track and report. Countries and FSPs are encouraged to consider additional indicators that help them better understand the terms of financing for WMSMEs compared to other MSMEs. FSPs track the number and volume of funds on each of these indicators (except non-performing loans) and disaggregate the overall MSME numbers by sex and size (micro and SME)

Other indicators may be needed for funds, fintechs, or other types of FSPs. These can be developed with the relevant industry association and oversight agency and in partnership with the Global Coordinator to harmonize minimum indicators for these groups.