Transforming Financial Systems to Better Serve Women Entrepreneurs

FOREWORD

Soraya M. Hakuziyaremye

Governor, National Bank of Rwanda

Unlocking Women’s Potential Is Smart Economics

Since its launch at the 2023 World Bank–IMF Annual Meetings, the Women Entrepreneurs Finance Code has achieved remarkable progress—mobilizing over 30 countries and hundreds of financial institutions around a shared goal: closing the gender finance gap through data, leadership, and coordinated action. The growing momentum of this global movement has been truly inspiring, and Rwanda is proud to be part of it.

At the National Bank of Rwanda, we view the Code as more than a statement of intent. It is a practical, evidence-based framework for building a more inclusive financial system. In Rwanda, women own 40% of businesses yet make up only 25% of borrowers. These numbers are not just statistics—they represent real opportunities for growth when systemic barriers are addressed.

Our journey toward inclusion is gaining ground. Today, Rwanda’s formal financial inclusion rate stands at 92%, with the gender gap in formal access reduced to from 11% to 4% in the last 8 years. Women’s adoption of mobile money has surged, and digital financial services are increasingly within their reach. These advances open the door to deeper impact—by improving access to capital, tailoring financial products to women’s needs, and scaling both financial and non-financial services that empower high-potential women entrepreneurs.

In May 2025, Rwanda took another important step by formally launching its national WE Finance Code. The Code was endorsed by the National Bank of Rwanda, the Ministry of Trade and Industry, all banks in the country, the Rwanda Bankers Association, and the Association of Microfinance Institutions in Rwanda—an unprecedented show of sector-wide alignment. As part of this initiative, the National Bank of Rwanda is also collaborating with the World Bank and the financial industry institutions to enhance the availability and use of gender-disaggregated MSMEs data.

The WE Finance Code complements Rwanda’s broader national strategies that champion equitable access to capital and opportunity. As regulators, our responsibility extends beyond maintaining financial stability—we must also ensure that the financial system serves the real economy and benefits all citizens.

The Code gives us a shared language, clear metrics, and a global community of practice. By learning from each other, we can continue to build financial systems that are inclusive, resilient, and ready for the future.

INTRODUCTION

Wendy Teleki, Head, We-Fi Secretariat

Across the world, women entrepreneurs are building businesses that create jobs, deliver essential services, and drive innovation. They are powerful engines of growth and resilience, investing in their families, and strengthening their communities.

Yet amid all this promise, a persistent challenge remains: access to finance. It continues to be one of the most significant barriers to the growth and success of womenowned businesses. Despite years of attention and effort, the gender finance gap has not closed. In many places, it has widened in the face of recent health emergencies and economic disruptions.

Addressing this gap requires action at scale. It demands bold, innovative mechanisms that drive accountability and accelerate progress.

The WE Finance Code is one such mechanism. It is central to our vision for women’s economic empowerment and for sustainable growth that delivers better jobs and livelihoods for all. The Code rests on three pillars essential to systems change: leadership, data, and action. It provides a common framework for countries and institutions to close gender finance gaps in ways that reflect their unique needs, capacities, and ambitions.

Launched at the 2023 World Bank-IMF Annual Meetings in Marrakesh, the WE Finance Code is gaining remarkable momentum. In just 18 months, 29 countries have joined, and more than 250 financial institutions have committed to reporting five core sex-disaggregated data points and to taking measurable steps to better serve women entrepreneurs.

This report captures the early results of those commitments: new lending products, stronger data systems, shifts in institutional behavior, and a growing understanding that financing women entrepreneurs is not charity, it is smart economics.

We are deeply grateful to the many national champions, financial leaders, development banks, and partners advancing this work. With strong support from We-Fi’s Governing Committee, comprised of 14 donor governments, and generous contributions from the Gates Foundation and the Visa Foundation, your collective action is turning a persistent challenge into a shared opportunity, and bringing the aspirations of millions of women entrepreneurs within reach.

The WE Finance Code:

A unified framework to support women entrepreneurs

Women entrepreneurs represent a powerful economic force, with approximately 400 million women-led businesses worldwide. These enterprises have immense potential to contribute to economic growth, create jobs, and add significant value to global markets. Research has consistently shown that women are a profitable, low-risk customer segment for financial service providers (FSPs). However, despite this potential, women entrepreneurs continue to face substantial barriers to accessing finance. Bridging this financing gap could generate an estimated $5-6 trillion in global economic value, while unlocking a $1.7 trillion growth opportunity for FSPs.

In this context, financial institutions, regulators, investors, and standard-setting bodies have a vital role to play in expanding access to finance for women entrepreneurs. By taking coordinated action, these stakeholders can help unlock the economic potential of women-led businesses.

A key challenge contributing to this financing gap is the limited availability and use of sex-disaggregated financial data. While demand-side data sources, such as the World Bank’s Findex survey, provide useful insights, they are often infrequent, costly, and difficult to sustain independently. On the supply side, gender-disaggregated data collected by FSPs offers a more practical solution. This type of data is granular, business-relevant, and can be gathered as part of routine portfolio monitoring. Crucially, it allows financial institutions to identify gaps in their services and tailor products and policies that better meet the needs of women.

Despite its value, sex-disaggregated financial data remains limited. To date, only two countries report on the share of financing directed to women-led SMEs as part of the OECD’s SME Scoreboard. Promoting data transparency through policy and advocacy is essential to ensuring financial systems and products are more inclusive of women. Failing to account for women in financial risk analysis, loan decisions, and guarantee mechanisms limits both economic growth and financial sector profitability.

The WE Finance Code is a global, multi-stakeholder framework, which is deployed by public-private coalitions at the country level, in line with national financial inclusion strategies. The Code is designed to open new doors for women entrepreneurs everywhere. Any institution that chooses to sign onto the Code in their country commits to helping close financing gaps for women entrepreneurs and to: 1) name a leader to be a champion for WMSMEs; 2) collect and report sex-disaggregated MSME finance data and 3) take other actions to support and finance women-led enterprises. The initiative is the first of its kind in encouraging diverse regions across the world to work toward the same goal of providing financing for WSMEs with a unified framework while respecting local contexts and needs.

The Code community receive support from the Organisation for Economic Co-operation and Development (OECD) for global data aggregation and analysis; the Financial Alliance for Women (FAW) for peer learning, trainings, and tools; and the We-Fi Secretariat for advocacy and implementation guidance in partnership with the African Development Bank (AfDB), Asian Development Bank (ADB), European Bank of Reconstruction and Development (EBRD), Inter-American Development Bank Group (IDB), Islamic Development Bank (IsDB), and the World Bank Group, comprised of the World Bank (WB) and International Finance Corporation (IFC).

The Code community receive support from the Organisation for Economic Co-operation and Development (OECD) for global data aggregation and analysis; the Financial Alliance for Women (FAW) for peer learning, trainings, and tools; and the We-Fi Secretariat for advocacy and implementation guidance in partnership with the African Development Bank (AfDB), Asian Development Bank (ADB), European Bank of Reconstruction and Development (EBRD), Inter-American Development Bank Group (IDB), Islamic Development Bank (IsDB), and the World Bank Group, comprised of the World Bank (WB) and International Finance Corporation (IFC).

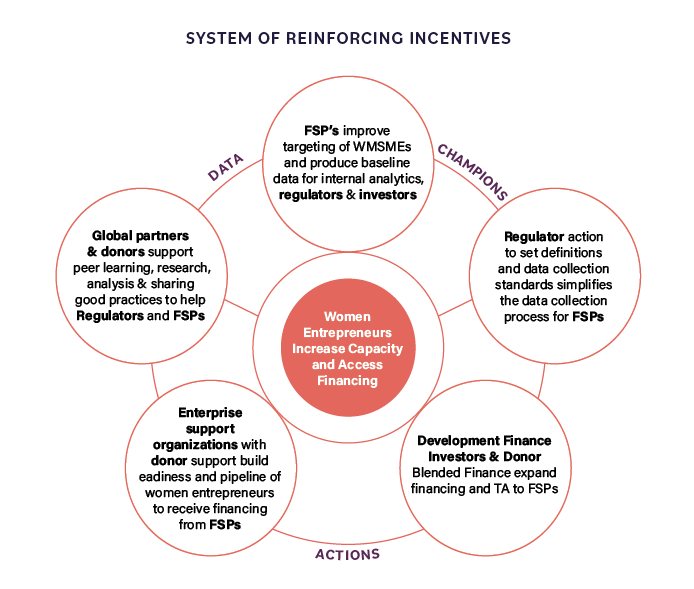

Leadership and Data are key enablers, but the ultimate impact of the Code will depend on the third FSP commitment: to take specific actions to close financing gaps for women entrepreneurs. These can be on the supply-side – more funding or new products and services; or on the demand-side – more training and capacity building. Ultimately, FSPs will take bold action if incentives are aligned and they see that serving the WMSME segment will help them build market share, customer loyalty and long-term profit, sustain their reputation and remain in compliance with regulatory requirements. The Code aims to affect this calculation by catalyzing a system of reinforcing incentives – from regulatory incentives, to financial incentives and market incentives – that will spur action.

Launched in October 2023 at the World Bank Annual Meetings, the WE Finance Code has had a remarkable first 18 months. This Inception Report highlights the progress made and the growing momentum across countries worldwide. To date, 29 countries, over 250 local financial institutions, and a dozen global partners have joined the Code community. Under the leadership of We-Fi’s Implementing Partners – the World Bank, IFC, EBRD, ADB, IsDB, IDBG, and AfDB – countries are building coalitions, engaging local champions, preparing for data collection, and identifying concrete actions to close financing gaps for women entrepreneurs.

The first year of the WE Finance Code has laid the foundation for lasting impact. Looking ahead, the community continues to build on this momentum, scaling up efforts to ensure that women entrepreneurs everywhere have the financial resources they need to thrive.

We-Fi has allocated funds to its implementing partners — including the World Bank, IFC, IDB, EBRD, ADB, IsDB, and AfDB — to support the implementation of the Code in dozens of countries, while the Gates Foundation funded the World Bank and UFGE and the Visa Foundation funded OECD and the Financial Alliance for Women’s work for the Code. Several additional countries have joined the Code without receiving funding.

The pilot phase has seen encouraging progress, with 29 countries either already committed or preparing to commit to the framework. Over 250 financial service providers have already signed on, with hundreds more expected to follow. Additionally, several more countries are actively considering joining the Code, further expanding its reach and impact.

Key Milestones

of the WE Finance Code

The First Two Years at a Glance:

Progress and Partnerships

The WE Finance Code’s first year has exceeded initial expectations. Originally envisioned as a pilot in 8-10 countries, the Code is now being piloted in 31 countries within its first two years. This rapid growth highlights both the model’s strength and the strong demand for initiatives that promote inclusive finance. These promising outcomes reinforce the Code’s potential to drive meaningful change on a global scale.

Our 31 pilot countries are at different stages of Implementation of the Code, most of them already onboarding FSP signatories to their National Code.

The Flexible Framework of the Code

Good Practices From the Community

The WE Finance Code is a flexible framework that allows countries to adapt its implementation to their specific local contexts. This adaptability ensures that each country can take strategic decisions that align with its unique financial landscape and needs. Key decisions include which financial intermediaries to encourage to join – ranging from banks and FinTechs to microfinance institutions and equity providers – or which WSME definitions to adopt – whether national, harmonized with global standards, or based on FIs’ own definitions.

Another decision to make is whether to have a private or public-sector organization lead the implementation as the Code Coordinator in-country. In some countries, such as the Dominican Republic and the Netherlands, the private sector has taken the lead due to the strong influence and impact of key financial institutions. These countries have benefited from the direct involvement of financial players who drive the agenda and ensure the Code’s integration into their business strategies. In other regions, such as the Balkans and Central Asia, countries have opted for a public-sector approach, with Central Banks or other government bodies taking the lead. This approach has proven effective in these regions, as it leverages the authority of public bodies to align the financial services sector with national policy goals and encourages broader participation.

Whether initially driven by the public or private sector, all national coalitions ultimately reflect strong collaboration between both, highlighting the flexible and customizable nature of the WE Finance Code and its adaptability across diverse country contexts.

The Flexible Framework of the Code

Good Practices From the Community

The focus of the pilot phase was to establish that the flexible framework and principles of the Code could generate interest and promote action to close financing gaps for women in developing countries. The first year of operation has shown that the concept is compelling and that the flexible framework works for a variety of countries and global and national institutions in the financial system.

The implementation of the Code follows five key steps, which countries can adapt to suit their unique contexts. Over the past year, we’ve been impressed by the diverse and thoughtful approaches taken across regions. In this chapter, we highlight these examples as sources of inspiration and learning for others embarking on a similar journey.